Accounting fundamentals, often found in PDF format, offer an overview of financial accounting objectives. Resources like textbooks – such as Millan’s edition –

cover core principles for beginners.

What is Accounting?

Accounting is fundamentally the systematic process of identifying, recording, classifying, summarizing, and interpreting financial transactions. It’s the “language of business,” providing crucial information for decision-making. Accounting fundamentals, readily available as a PDF download, detail this process, starting with basic definitions and objectives.

Resources like freely available notes and textbooks – including those by Wild & Shaw – illustrate how accounting tracks a company’s financial performance and position. These materials often cover the core principles, enabling individuals to understand financial statements and reports. Learning accounting basics, whether through elearning or textbooks, is essential for anyone seeking a career upgrade or a better understanding of business finances.

The Importance of Accounting

Accounting is vital for both internal and external stakeholders. Internally, it provides management with the data needed for informed decisions regarding resource allocation and performance evaluation. Externally, it offers investors, creditors, and regulators insights into a company’s financial health. Accounting fundamentals, often accessible in PDF format, highlight this significance.

Understanding these fundamentals – through resources like Millan’s textbook or online courses – can lead to career advancement and higher earning potential. The ability to interpret financial information is crucial in today’s business world. Resources like the Open Textbook Library offer accessible learning materials, while cheat sheets aid in mastering the accounting cycle. Ultimately, accounting ensures transparency and accountability.

Core Accounting Concepts

Accounting fundamentals, often in PDF form, build upon key concepts like the accounting equation, debits/credits, and GAAP principles for standardized reporting.

The Accounting Equation (Assets = Liabilities + Equity)

Fundamental accounting principles, often detailed in PDF guides, center around the accounting equation: Assets = Liabilities + Equity. This equation represents the core of a company’s financial position. Assets encompass what a company owns – cash, accounts receivable, and property. Liabilities represent what the company owes to others – accounts payable, loans, and deferred revenue.

Equity, also known as owner’s equity or shareholders’ equity, signifies the owner’s stake in the company. Understanding this equation is crucial because every financial transaction impacts at least two accounts, ensuring the equation always remains balanced. Resources like introductory textbooks emphasize this balance as a cornerstone of accurate financial reporting. Mastering this concept, readily available in accounting fundamentals PDF materials, is essential for anyone learning accounting.

Debits and Credits Explained

Accounting fundamentals PDF resources consistently explain debits and credits as the building blocks of the accounting system. These aren’t inherently “good” or “bad,” but rather represent increases or decreases to different account types. The rule is: Assets, Expenses, and Dividends increase with a debit, while Liabilities, Owner’s Equity, and Revenue increase with a credit.

This seemingly simple system ensures the accounting equation remains balanced. Every transaction requires at least one debit and one credit, with the total debits always equaling total credits. Learning these rules, often through practice in accounting fundamentals materials, is vital. Many online resources and cheat sheets, like those found at accountingstuff.co, offer visual aids to solidify understanding of this core concept.

Generally Accepted Accounting Principles (GAAP)

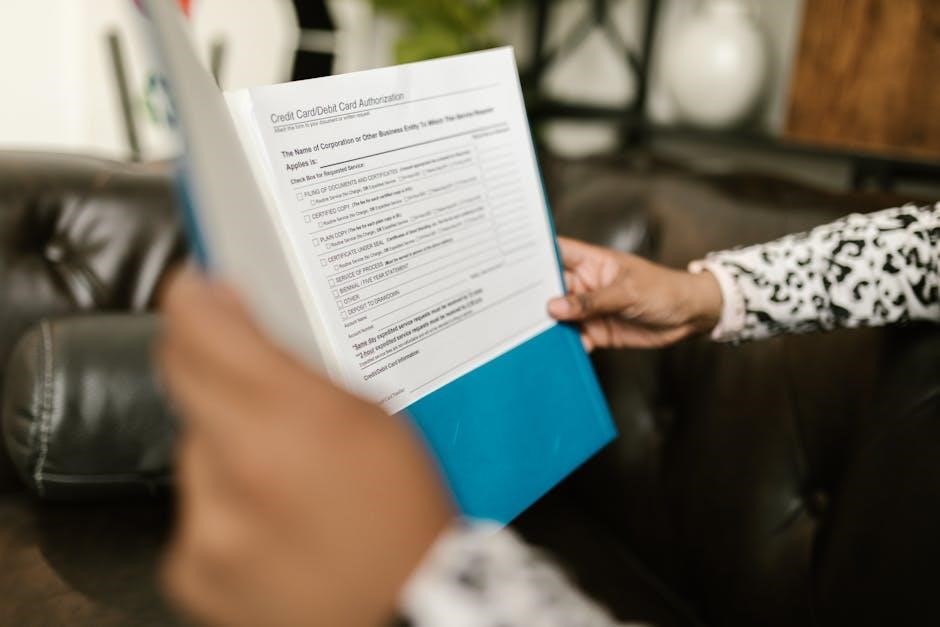

Generally Accepted Accounting Principles (GAAP) are a cornerstone of accounting fundamentals, frequently detailed in PDF study guides. These principles standardize financial reporting, ensuring consistency and comparability across organizations. Adherence to GAAP is crucial for reliable financial statements, allowing stakeholders to make informed decisions.

Key aspects covered in accounting fundamentals materials include the historical cost principle and the matching principle. While resources like Millan’s textbook aim to be up-to-date, the evolving landscape – including the CPA exam and data analytics – suggests a need for continuous updates to GAAP coverage. Understanding GAAP is not merely about rules, but about the rationale behind them, fostering transparency and trust in financial reporting.

Financial Statements

Financial statements – including the income statement and balance sheet – are key outputs of accounting fundamentals, often detailed in PDF resources for analysis;

The Income Statement

The Income Statement, a crucial component detailed in many accounting fundamentals PDF guides, reports a company’s financial performance over a specific period. It showcases revenues, expenses, and ultimately, net income or loss. Understanding this statement is foundational, as it reveals profitability and operational efficiency.

Resources like introductory textbooks emphasize the importance of accurately calculating revenue and matching it with corresponding expenses – a core principle. These PDF materials often include illustrative examples, demonstrating how to interpret key metrics like gross profit and operating income. Learning to analyze the income statement allows stakeholders to assess a company’s ability to generate profits and sustain growth, making it a vital skill in financial literacy.

The Balance Sheet

The Balance Sheet, frequently explained in accounting fundamentals PDF resources, presents a company’s assets, liabilities, and equity at a specific point in time. It adheres to the fundamental accounting equation: Assets = Liabilities + Equity. This snapshot provides insights into a company’s financial position and solvency.

Many introductory materials emphasize that assets represent what a company owns, liabilities what it owes, and equity the owners’ stake. PDF guides often detail how to classify assets (current vs. non-current) and liabilities. Analyzing the balance sheet helps assess a company’s liquidity, financial flexibility, and overall financial health, making it a cornerstone of financial statement analysis.

The Statement of Cash Flows

The Statement of Cash Flows, a key component detailed in accounting fundamentals PDF guides, tracks the movement of cash both into and out of a company during a specific period. It categorizes these flows into three activities: operating, investing, and financing. Understanding these classifications is crucial for interpreting a company’s financial health.

PDF resources often highlight how this statement differs from the income statement and balance sheet, focusing specifically on cash rather than accrual-based accounting. Analyzing cash flow reveals a company’s ability to generate cash, meet obligations, and fund future growth. It’s a vital tool for investors and creditors assessing financial viability.

Statement of Retained Earnings

The Statement of Retained Earnings, frequently explained within accounting fundamentals PDF materials, details the changes in a company’s retained earnings over a reporting period. Retained earnings represent the accumulated profits of a company that have not been distributed to shareholders as dividends. This statement begins with the beginning retained earnings balance.

PDF guides emphasize that net income increases retained earnings, while dividends decrease it. The statement concludes with the ending retained earnings balance, which is then carried forward to the next period’s statement. Understanding this statement is vital for assessing a company’s profitability and dividend policy, offering insights into financial performance.

Accounting Cycle

Accounting fundamentals PDF resources detail the cycle: journal entries, ledger accounts, trial balance, and adjusting entries – a systematic process for recording financial transactions.

Journal Entries

Journal entries represent the foundational step within the accounting cycle, meticulously documented in accounting fundamentals PDF guides. These entries chronologically record each financial transaction, detailing the date, accounts affected, and the debit/credit amounts. Understanding this process is crucial, as it forms the basis for all subsequent accounting procedures.

A proper journal entry adheres to the double-entry bookkeeping system, ensuring the accounting equation (Assets = Liabilities + Equity) remains balanced. Resources like cheat sheets, available online, visually demonstrate this process. Mastering journal entries requires a firm grasp of debit and credit rules, and a clear understanding of how each transaction impacts various accounts. Accurate journalizing is paramount for reliable financial reporting and analysis, as highlighted in introductory accounting materials.

Ledger Accounts

Ledger accounts, detailed in accounting fundamentals PDF resources, are the core repositories of a company’s financial information. Following the initial recording of transactions via journal entries, information is transferred – a process called posting – to individual ledger accounts. These accounts categorize transactions by type, such as cash, accounts receivable, or accounts payable.

Each ledger account maintains a running balance, providing a clear snapshot of the financial position for that specific element. The accounts are typically organized using a T-account format, visually separating debits and credits. Understanding ledger accounts is vital for preparing financial statements and analyzing a company’s performance. Resources emphasize the importance of accurate posting to ensure the integrity of the financial records, a key concept in introductory accounting materials.

Trial Balance

A trial balance, frequently explained in accounting fundamentals PDF guides, is a listing of all general ledger accounts and their balances at a specific point in time. Its primary purpose is to verify the mathematical equality of debits and credits after posting journal entries. This ensures the accounting equation – Assets = Liabilities + Equity – remains in balance.

While a trial balance doesn’t guarantee the accuracy of all transactions, it helps identify potential errors. Discrepancies between debit and credit totals signal a need for further investigation. Resources highlight that a trial balance is a crucial step in the accounting cycle, preceding the preparation of financial statements. It’s a foundational tool for accountants, ensuring a solid basis for financial reporting.

Adjusting Entries

Adjusting entries, detailed in many accounting fundamentals PDF resources, are crucial journal entries made at the end of an accounting period to update account balances before preparing financial statements. These entries aren’t based on original source documents but are necessary to adhere to the accrual accounting principle.

Common adjustments include accrued revenues, accrued expenses, deferred revenues, and deferred expenses. They ensure revenues are recognized when earned and expenses when incurred, regardless of cash flow. Mastering these entries, as explained in introductory texts, is vital for accurate financial reporting. Adjusting entries impact both the income statement and balance sheet, providing a true and fair view of a company’s financial position.

Cost Accounting Fundamentals

Cost accounting, often detailed in accounting fundamentals PDF guides, focuses on a company’s costs and their behavior, relating closely to financial accounting principles.

Meaning and Definition of Cost Accounting

Cost accounting is a specialized branch of accounting concerned with recording, classifying, summarizing, and interpreting cost information for internal use. Unlike financial accounting, which focuses on external reporting, cost accounting aids management in decision-making, planning, and controlling operations.

Resources like accounting fundamentals PDF documents often define it as the process of determining the cost of products, processes, projects, or activities within an organization. This involves analyzing both fixed and variable costs, direct and indirect costs, and applying various costing methods.

Understanding these costs is crucial for pricing strategies, profitability analysis, and operational efficiency. It’s a vital tool for businesses aiming to optimize resource allocation and improve their bottom line, complementing the broader principles outlined in foundational accounting texts.

Relationship to Financial Accounting

Cost accounting and financial accounting are interconnected yet distinct disciplines. While financial accounting provides a broad overview of a company’s financial performance for external stakeholders – utilizing principles detailed in accounting fundamentals PDF guides – cost accounting delves deeper into the specifics of production costs.

Information generated by cost accounting systems directly feeds into financial statements. The cost of goods sold, reported on the income statement, is a primary output of cost accounting. Similarly, inventory values on the balance sheet rely on accurate cost calculations.

Essentially, cost accounting provides the detailed data necessary for preparing accurate financial reports. Both disciplines adhere to GAAP, ensuring consistency and comparability, but serve different purposes and audiences within and outside the organization.

Key Accounting Principles

Accounting fundamentals PDF resources detail principles like accrual versus cash accounting, the matching principle, and the historical cost principle – foundational concepts for accurate reporting.

Accrual Accounting vs. Cash Accounting

Accrual accounting and cash accounting represent fundamentally different approaches to recognizing revenue and expenses, often detailed within accounting fundamentals PDF guides. Cash accounting, the simpler method, records transactions when cash changes hands – revenue when received, and expenses when paid. This is suitable for small businesses.

Conversely, accrual accounting recognizes revenue when earned, and expenses when incurred, regardless of cash flow. This provides a more accurate picture of a company’s financial performance, aligning with GAAP. PDF resources emphasize that accrual accounting offers a better long-term view, though it’s more complex. Understanding this distinction is crucial for interpreting financial statements and applying core accounting principles effectively.

Matching Principle

The matching principle, a cornerstone of accrual accounting detailed in accounting fundamentals PDF materials, dictates that expenses should be recognized in the same period as the revenues they help generate. This isn’t simply about timing; it’s about accurately portraying profitability.

For example, the cost of goods sold is matched with the revenue from selling those goods. GAAP heavily relies on this principle. PDF guides illustrate how this differs from cash accounting, where expenses are recorded when paid, potentially distorting the financial picture. Proper application ensures a clear link between effort and result, providing a more reliable assessment of a company’s financial health and performance over time.

Historical Cost Principle

The historical cost principle, a fundamental concept explained in accounting fundamentals PDF resources, states that assets should be recorded at their original purchase price. This means an asset’s value on the balance sheet remains constant, regardless of market fluctuations. While seemingly simple, it’s a core tenet of GAAP.

PDF guides emphasize that this principle provides objectivity and verifiability. It avoids subjective valuations based on current market conditions. Though some adjustments like depreciation are allowed, the initial recording relies on the transaction’s actual cost. This approach, while sometimes differing from current market value, offers a reliable and consistent basis for financial reporting, ensuring comparability across periods.

Accounting Software & Resources

Accounting fundamentals PDF resources complement software learning. Options range from popular programs to free online courses and Open Textbook Library materials.

Popular Accounting Software Options

Understanding accounting fundamentals, even with a PDF guide, is greatly enhanced by practical application using software. Numerous options cater to diverse needs and budgets.

While specific software isn’t directly mentioned in the provided text, the context suggests a need for tools to implement learned principles. Many popular choices exist, including QuickBooks, Xero, and Sage Intacct. These platforms automate tasks like journal entries and financial statement generation.

For those starting out, exploring free trials or cloud-based solutions can be beneficial. The ability to link learned fundamentals to real-world software applications solidifies comprehension and prepares individuals for professional roles. Resources often highlight career advancement opportunities linked to software proficiency.

Free Online Accounting Courses

Supplementing your study of accounting fundamentals – perhaps with a PDF resource – with free online courses is a smart strategy. The provided text points towards readily available learning opportunities.

Numerous platforms offer introductory accounting courses, often covering the same core principles found in textbooks like those by Wild & Shaw or Millan. These courses can range from short tutorials to more comprehensive programs.

The Open Textbook Library is specifically mentioned as a valuable resource, providing access to materials covering introductory financial accounting. Furthermore, platforms like Coursera, edX, and Khan Academy frequently host free accounting courses. Utilizing these resources alongside foundational materials strengthens understanding and prepares learners for more advanced topics.

Open Textbook Library Resources

The Open Textbook Library provides a significant resource for students studying accounting fundamentals, potentially complementing a PDF guide. This library offers a complete text covering all topics typically found in an introductory financial accounting course – often referred to as ‘Principles of Accounting I’.

This freely accessible textbook serves as a viable alternative to traditional, costly textbooks. It ensures students have access to comprehensive materials without financial barriers. The content aligns with core concepts, aiding comprehension of the accounting equation, financial statements, and the accounting cycle.

Leveraging this resource alongside other materials, like online courses or foundational texts, can create a robust learning experience. It’s a valuable tool for self-study and reinforces understanding of key accounting principles.

Advanced Topics (Brief Overview)

Accounting fundamentals, even in PDF form, are evolving. Modern accounting increasingly integrates data analytics, and future CPA exams will reflect this shift.

Data Analytics in Accounting

Data analytics is rapidly transforming the accounting profession, moving beyond traditional fundamentals often found in introductory PDF guides. Accountants are now leveraging tools to analyze large datasets, identifying trends and anomalies previously undetectable through manual processes.

This shift necessitates a deeper understanding of data mining, statistical analysis, and visualization techniques. While core accounting principles remain vital – as outlined in resources like Wild & Shaw’s textbook – proficiency in data analytics enhances fraud detection, risk assessment, and forecasting accuracy.

The evolving CPA exam reflects this demand, placing greater emphasis on analytical skills. Professionals equipped with these capabilities gain a competitive edge, offering valuable insights to stakeholders and driving informed business decisions. Embracing data analytics isn’t replacing accounting fundamentals; it’s augmenting them.

Impact of CPA Exam Changes

Recent changes to the Certified Public Accountant (CPA) exam significantly impact the study of accounting fundamentals, traditionally covered in introductory PDF materials. The exam now places increased emphasis on critical thinking, data analysis, and evolving business environments.

Candidates must demonstrate a deeper understanding of core principles, applying them to complex scenarios rather than rote memorization. This shift necessitates a move beyond simply mastering textbook concepts – like those in Millan’s Financial Accounting and Reporting Fundamentals – towards developing problem-solving skills.

The updated exam reflects the profession’s growing need for accountants who can interpret data, assess risk, and provide strategic advice. Consequently, aspiring CPAs must supplement traditional fundamentals with advanced analytical training to succeed.

Resources for Further Learning

Accounting fundamentals are readily available through textbooks like Wild & Shaw’s, and Millan’s Financial Accounting and Reporting Fundamentals, often in PDF format.

Fundamental Accounting Principles Textbook (Wild & Shaw)

Fundamental Accounting Principles by John Wild and Ken Shaw is a widely recognized textbook for grasping accounting fundamentals. Available in various formats, including potentially as a PDF, this resource (ISBN 9781264126736) provides a comprehensive foundation in accounting concepts.

The textbook systematically covers core principles, making it suitable for introductory courses. It’s designed to build a strong understanding of financial accounting, equipping students with the necessary knowledge to analyze and interpret financial information. While current as of its publication, supplemental resources may be needed to address evolving areas like data analytics’ increasing role in the field, and changes to the CPA exam.

Students can benefit from its clear explanations and practical examples, solidifying their grasp of essential accounting fundamentals.

Financial Accounting and Reporting Fundamentals (Millan)

Financial Accounting and Reporting Fundamentals, 2nd Edition by Zeus Vernon Millan, serves as a valuable resource for understanding accounting fundamentals. Often accessible online or potentially as a PDF, this textbook from the University provides an up-to-date exploration of financial accounting principles, boasting a 2019 copyright.

Millan’s work comprehensively covers essential topics, making it ideal for introductory financial accounting courses. It equips students with the knowledge to navigate the complexities of financial statements and reporting. However, future updates could benefit from incorporating the evolving landscape of the CPA exam and the growing importance of data analytics within the accounting profession.

This textbook offers a solid base for mastering accounting fundamentals.